SME Network is a foreign trade advisory firm at Bangalore. We offer full fledge advisory, Transaction Processing,Compliance services for industries and business involving Foreign Trade in the areas of Foreign Trade Policy, GST,Customs, Bilateral Trade Agreements, and Trade Finance / Factoring. With focus on SME’s we have provided our clients timely access to benefits / refunds and ensured compliancesproactively and consistently from the year 2002. Our services are tailored to the client’s needs so as to enable them to optimize the benefits and complywith the regulations. We focus on strategic planning for long term growth by harnessing the inherent strengths of the client. By employing our services, our clients are assured of finding the right solution for their business needs.

FOREIGN TRADE ADVISORY SERVICE :

Foreign Trade Policy:

- IEC / RCMC registration and

modification - Merchandise Export India Scheme

- Service Export India Scheme

- EPCG Authorizations

- Advance Authorizations

GST

- Concessional clearances and

annexures - Registration under GST

- Filing of Returns

- Refunds of Input Credit

- Opinions

WeP Suvidha Kendra (Master Franchisee):

- GST Enrollment

- Salaried Individual Tax Filing

- ITR With CA Signature

- Business Tax Returns

- Digital Signature for 2 Years

Class II Multi purpose

Customs

- Special Valuation Branch

registration / finalization /

renewals Refunds - Registration and formation of

Public/Private Bonded

Warehouse - Brand Rate Duty Drawback fixa-

tion and refund

Export Financing

- Export – Post Shipment factoring

in foreign Currency - Exchange Rate realization /

conversion–review and optimiz-

ation - Short Term / Long Term External

Commercial Borrowing for CAPEX

Grants and Subsidies

- Project Report for new and

expansion projects - Project Finance from Banks

and NBFC - DSIR / DSIT Scheme registration

and incentives

ABOUT US

LATEST NEWS

Changes in E-Way Bills

The National Informatics Centre E-way Bill Project has published a list of improvements in the E-way Bill under the Goods and Services Tax (GST) regime. The changes would be applicable with effect from 16th November 2018.

As per the document issued by the NIC, the following changes will be made in the e-way bills…….

As per the document issued by the NIC, the following changes will be made in the e-way bills…….

GST paid under a Wrong Head by Mistake can be transferred to the Right Head: Kerala HC

The Kerala High Court has directed the GST department to transfer the tax amount paid by the petitioner under a wrong head instead of another by mistake.

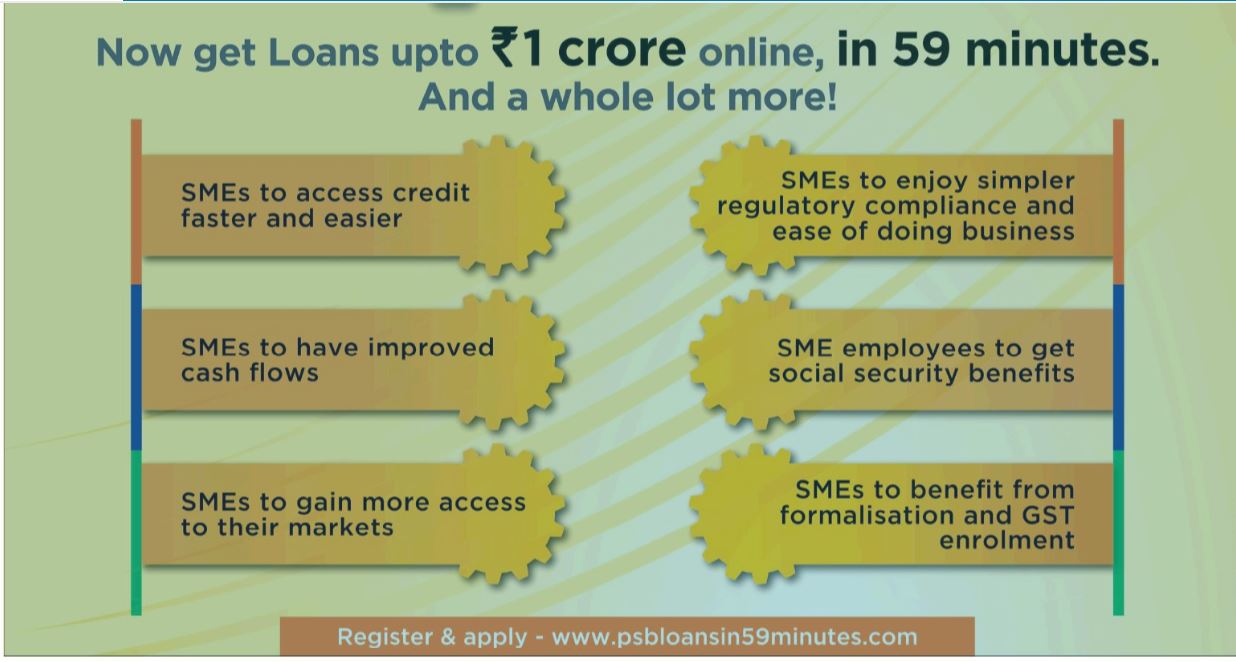

MSME Loans - CGTMSE

MSME Loans in 59 Minutes thru Public Sector Banks